2025-06-13: Formosa Plastics Launches Strategic Investment Shift in Semiconductors, Green Energy, and Digital Transformation

TSMC and University of Tokyo Launch Joint Lab for Sustainable Semiconductor Innovation

Good Morning,

Below are some of the most important developments in the artificial intelligence, semiconductors, and cloud computing sectors in Asia today.

▪️ Taiwan: AI-Driven Production Surge Accelerates Overtime and Export Growth in Taiwanese Manufacturing and Semiconductors

Global demand for AI applications is fueling a surge in overtime and production across Taiwan’s manufacturing and semiconductor industries.

▪️ Taiwan: Formosa Plastics Launches Strategic Investment Shift in Semiconductors, Green Energy, and Digital Transformation

Formosa Plastics embarks on an ambitious expansion and transformation strategy fueled by investments in semiconductors, green energy and digitalization.

▪️ Taiwan: TSMC and University of Tokyo Launch Joint Lab for Sustainable Semiconductor Innovation

Taiwan Semiconductor Manufacturing Company and the University of Tokyo have inaugurated the TSMC-UTokyo Lab to advance research, education, and talent development in next-generation sustainable semiconductor technologies.

▪️ South Korea: Artificial Intelligence Reshapes South Korea’s Distribution Sector Amid Government Initiatives

South Korea’s distribution industry is on the verge of a major transformation driven by government initiatives and artificial intelligence innovation.

▪️ South Korea: Semiconductor Export Surge Reshapes South Korea’s Trade Landscape

South Korea’s semiconductor sector is driving significant export growth and reshaping the country’s trade dynamics.

For more information on these developments, please see the full report below.

Thanks for reading,

Rodney J Johnson

Today's Developments

Widely Reported On Issues of Importance

-

AI-Driven Production Surge Accelerates Overtime and Export Growth in Taiwanese Manufacturing and Semiconductors

Global demand for AI applications is fueling a surge in overtime and production across Taiwan’s manufacturing and semiconductor industries.

Overtime in Taiwan’s manufacturing sector climbed to 17.8 hours in April, marking an eight-and-a-half-year high.

The electronic components segment of the semiconductor industry recorded 27.9 overtime hours in April—the highest level in nearly 46 years. Companies attribute this sharp rise to robust global demand for AI applications and higher production linked to US reciprocal tariffs.

As overtime hours increased, average overtime pay reached NT$2,423 in April, the highest on record for that month.

In the first four months of the year, both the manufacturing and service sectors posted average monthly overtime hours at 14-year highs, reflecting sustained high production intensity across these industries.

Export performance remained strong through the first four months of the year: total exports reached US$178.2 billion, up 20.6% year-on-year.

Average total working hours across all industries stood at 167 hours in April, a slight increase from the previous year. At the end of April, Taiwan’s total employment hit 8.492 million, with the manufacturing and support service industries adding 66,000 jobs year-on-year over the first four months of 2025.

References for this Development

台玻不配息! 林伯豐:AI需求強擲22億改四廠「接班穩股東安心」

Yahoo News Taiwan | Local Language | News

AI 需求、關稅效應引爆拉貨潮 電子零組件加班工時攀高

United Daily News | Local Language | News

-

Formosa Plastics Launches Strategic Investment Shift in Semiconductors, Green Energy, and Digital Transformation

Formosa Plastics embarks on an ambitious expansion and transformation strategy fueled by investments in semiconductors, green energy and digitalization.

Last year, the company recorded a consolidated pre-tax loss of 2.4 billion yuan after China’s real-estate downturn, weak domestic demand and overcapacity sparked intense price competition in petrochemicals.

At its June 11, 2025 shareholder meeting, newly appointed chair Kuo Wen-bi presided over a calm session despite those challenges. Improved market conditions drove a first-quarter pre-tax profit of 100 million yuan, but US reciprocal tariffs and exchange-rate volatility cloud prospects for the second quarter.

Kuo expressed confidence that supportive Chinese policies—such as reserve requirement and interest rate cuts—will stimulate domestic demand in the second half of 2025.

He also cited seasonal peak demand for petrochemical products in the third quarter and anticipated cost savings from lower crude oil and raw-material prices following OPEC’s production increases.

To secure sustainable growth, Formosa Plastics unveiled a 58.5-billion-yuan investment plan across three innovation pillars—semiconductors, green energy and environmental protection—and four strategic axes: new product and business development, energy transformation, digital transformation and a global investment footprint spanning Taiwan, mainland China and the United States.

In the semiconductor sector, the company will allocate 28.5 billion yuan to 17 high-value products, aiming to boost annual revenue by NT$23 billion.

Its four key initiatives ensure a stable supply of liquid alkali for wastewater treatment, develop electronic-grade chemicals and gases, build a new 12-inch silicon wafer plant in Mailiao, and expand production capacity for electronic-grade hydrofluoric acid and isopropyl alcohol.

For energy transformation, Formosa Plastics will invest 4.3 billion yuan in wind and solar generation units to produce 200 million kWh of renewable electricity by 2030 and cut carbon emissions by 184,000 tons annually.

Under its digital transformation drive, the company plans 576 AI development projects expected to deliver substantial financial gains, though the precise figures were not disclosed.

As part of its global investment layout, Formosa Plastics is advancing seven expansion projects with a combined investment of NT$21 billion, including new plants in Taiwan and Texas.

It will also build additional storage tanks and a salt warehouse to improve raw-material purchasing flexibility, generating annual benefits of 470 million yuan. Overall, 131 improvement projects this year carry an estimated investment of 4.7 billion yuan, projected to yield 120 million yuan in annual benefits.

Facing US tariff pressures, Formosa Plastics intends to diversify its customer base by targeting India and Southeast Asia, where chemical demand is poised to grow significantly.

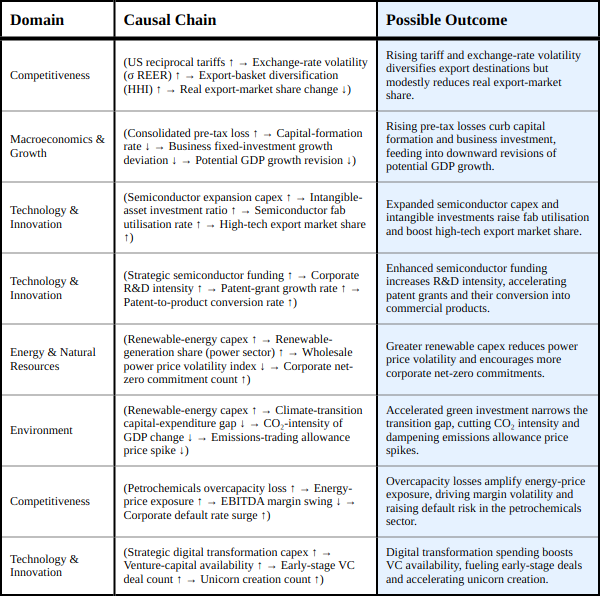

IMPACT ANALYSIS

From this Development, various impacts could cascade through the system, to a lesser or greater extent, depending on the severity and criticality of the shocks.

BOTTOM LINE

Last year’s 2.4 billion-yuan pre-tax loss eroded Formosa Plastics’ internal funding capacity, which is likely to weigh on its capital-formation rate and contribute to weaker business fixed-investment growth, potentially prompting downward revisions to regional potential GDP projections.

Ongoing US reciprocal tariffs combined with heightened exchange-rate volatility have driven Formosa Plastics to re-orient its export basket toward India and Southeast Asia; this diversification reduces tariff exposure but may marginally erode its established real export-market share in North America.

The announcement of a 58.5 billion-yuan strategic investment plan across semiconductors, green energy and digital transformation signals a fundamental shift toward higher-value and sustainable business lines, which should bolster the company’s intangible-asset ratio and position it for medium-term growth.

Allocating 28.5 billion yuan to 17 high-value semiconductor products, including a new 12-inch wafer fab and expanded electronic-grade chemical capacity, is expected to lift semiconductor fab utilization rates, boost high-tech export market share and accelerate the translation of patents into commercial products.

Investing 4.3 billion yuan in wind and solar generation to produce 200 million kWh of renewable electricity by 2030 will increase Formosa’s renewable-generation share, smooth wholesale power price volatility, attract additional corporate net-zero commitments and narrow the gap in climate-transition capital expenditures while reducing CO₂ intensity per unit of GDP.

The rollout of 576 AI and digitalization projects is poised to stimulate demand for advanced analytics, automation and software solutions in heavy industry, which could catalyze venture-capital availability, increase early-stage deal counts and accelerate the emergence of new industrial-tech unicorns.

Formosa Plastics’ global investment footprint—with seven expansion projects in Taiwan and Texas and expanded storage-tank capacity—will improve raw-material purchasing flexibility, generate roughly 470 million yuan in annual operational benefits and strengthen the resilience of its supply chain.

Continued overcapacity in petrochemicals, coupled with elevated energy-price exposure, will sustain EBITDA-margin volatility for Formosa and its industry peers, potentially putting pressure on credit ratings and heightening default risk if low-price conditions persist.

Supportive Chinese monetary and regulatory measures—such as reserve-requirement and interest-rate cuts—and anticipated seasonal demand peaks could provide a tailwind for Formosa Plastics’ revamped portfolio in the second half of 2025, helping to offset external headwinds.

References for this Development

不是塑膠做的! 台塑巨資投入「這領域」不看淡下半年展望

Yahoo News Taiwan | Local Language | News

台塑轉型 啟動585億大投資…衝刺半導體、綠能等三大創新事業

Yahoo Finance | Local Language | News

台塑積極布局半導體︰今年業績會比去年好

Liberty Times Net | Local Language | News

台塑股東會》2024年虧損24億收場!中國市場拖累 力拚轉型下半年反轉

Yahoo News Taiwan | Local Language | News

台塑股東會董座郭文筆處女秀 今年營運會比去年好

Liberty Times Net | Local Language | News

虧損也配0.5元 台塑:不看淡下半年營運

Formosa Plastics: No pessimism about second half operations despite losses

United Daily News | Local Language | News

台塑董座郭文筆:原料看跌 有利下半年營運

Liberty Times Net | Local Language | News

台塑股東會/董事長郭文筆:投資585億 提高經營績效及轉型

United Daily News | Local Language | News

台塑今年能否虧轉盈? 董座郭文筆:下半年不看淡

Yahoo Finance | Local Language | News

-

Keep reading with a 7-day free trial

Subscribe to Cognitive Asia to keep reading this post and get 7 days of free access to the full post archives.