2025-05-07: Vietnam Enacts Preferential Policies and Legislative Reforms to Accelerate Innovation

New Taiwan Dollar Surge Triggers Market Volatility

Good Morning,

Below are some of the most important developments in the artificial intelligence, semiconductors, and cloud computing sectors in Asia today.

▪️ India: Synthetic Data Accelerates Secure AI Development Across Indian Industries

Synthetic data offers a powerful tool for businesses and government agencies in India to develop AI applications without compromising sensitive information.

▪️ Vietnam: Draft Law Empowers Research Autonomy and Incentivizes Innovation in Science and Technology

The Government’s draft Law on Science, Technology and Innovation aims to grant research organizations greater autonomy, formally accept research risks, and establish performance-based incentives to drive scientific progress and national competitiveness.

▪️ Vietnam: Vietnam Enacts Preferential Policies and Legislative Reforms to Accelerate Innovation and Technology Development

Vietnam’s government has introduced a series of policies and legislative proposals to foster innovation and science and technology development.

▪️ Taiwan: New Taiwan Dollar Surge Triggers Market Volatility and Sectoral Shifts

The New Taiwan dollar’s sharp appreciation against the US dollar has triggered volatility in Taiwan’s tech, semiconductor sectors, and related ETFs.

▪️ Taiwan: Huawei accelerates push for AI chip self-sufficiency with new Shenzhen fabrication plants

China’s Huawei is advancing a comprehensive strategy to achieve self-sufficiency in high-end AI chip production.

For more information on these developments, please see the full report below.

Thanks for reading,

Rodney J Johnson

Today's Developments

Widely Reported On Issues of Importance

-

Synthetic Data Accelerates Secure AI Development Across Indian Industries

Synthetic data offers a powerful tool for businesses and government agencies in India to develop AI applications without compromising sensitive information.

Synthetic data mimics the statistical patterns of real-world datasets while excluding personally identifiable information, making it a compliant and valuable asset for AI model training. When regulatory constraints or privacy concerns limit access to real records, high-quality synthetic datasets can augment scarce data supplies and accelerate development.

By eliminating PII, synthetic data meets strict privacy requirements and appeals to highly regulated sectors such as healthcare and finance.

Organizations can generate large, diverse synthetic samples that strengthen model robustness without the time and cost associated with collecting, labeling, and preparing real data. This scalability reduces preparation overhead and delivers a cost-effective way to speed up AI development cycles.

Healthcare providers use synthetic data to develop and test diagnostic tools without risking patient privacy, while financial institutions simulate scenarios for fraud detection and risk management without revealing client information.

Automotive companies train autonomous driving systems in varied conditions without endangering lives, and robotics and retail industries employ synthetic environments for simulation and training. Red Hat’s InstructLab project further demonstrates how controlled synthetic inputs enhance language understanding and generation in advanced AI models.

Despite these advantages, synthetic data can fall short in capturing complex real-world edge cases, potentially limiting model performance when used alone.

If generation processes do not address bias sources in original data, they may also perpetuate those biases. To create reliable, unbiased AI solutions, organizations combine synthetic and real-world datasets and implement comprehensive bias-monitoring frameworks throughout the data lifecycle.

References for this Development

From browsing to buying: AI transforms e-commerce journey

Hindu Business Line | English | News

Haryana cabinet approves Rs 474 cr AI Development project

Deccan Herald | English | News

Synthetic data enables AI without compromising privacy: Red Hat

Hindu Business Line | English | News

-

Vietnam: Draft Law Empowers Research Autonomy and Incentivizes Innovation in Science and Technology

The Government’s draft Law on Science, Technology and Innovation aims to grant research organizations greater autonomy, formally accept research risks, and establish performance-based incentives to drive scientific progress and national competitiveness.

The draft law comprises eight chapters and 83 articles that decentralize decision-making, allowing institutions to approve projects, allocate resources, and disburse budgets independently. By shifting authority to research organizations, the government intends to accelerate research processes and cut bureaucratic delays.

Under Article 9 and related provisions, organizations and individuals conducting scientific research face no administrative or civil liability for damages from unsuccessful projects, provided they follow prescribed protocols and avoid fraud or fund misuse.

This procedure-based accountability encourages scientists to pursue high-impact, complex challenges without fearing penalties for experimental failures.

The legislation allows institutions to retain ownership of their discoveries and related assets while securing at least a 30% share of commercialization revenues.

It also permits researchers to participate directly in enterprise operations and offers personal income tax incentives, profit-sharing from commercialized research, and mechanisms to attract foreign experts. By explicitly positioning innovation alongside science and technology, the law seeks to foster both entrepreneurial and academic pursuits.

Introduced to the National Assembly on May 6 by Deputy Prime Minister Le Thanh Long, the draft implements Party guidelines that designate science, technology, and innovation as engines of national competitiveness, socio-economic development, national defense, and improved quality of life.

It extends regulatory coverage to the non-public sector to drive scientific research and digital transformation, and it ties funding to performance—rewarding high performers with additional support and reducing backing for underperformers.

The National Assembly’s Committee on Science, Technology and Environment, chaired by Le Quang Huy, endorsed the draft’s overall direction but recommended clearer criteria to distinguish acceptable research risks from malpractice and tighter controls to prevent abuse of liability exemptions.

The Committee also stressed the critical role of enterprises in advancing innovation and urged cohesive alignment with existing investment, finance, and resource-development regulations.

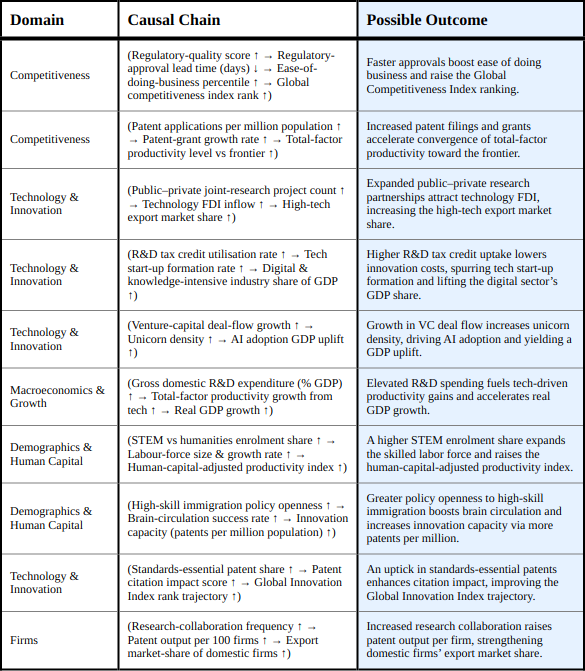

IMPACT ANALYSIS

From this Development, various impacts could cascade through the system, to a lesser or greater extent, depending on the severity and criticality of the shocks.

BOTTOM LINE

The Research Liability Exemption shock removes administrative and civil penalties for bona fide experimental failures, thereby lowering scientists’ risk aversion and catalyzing high-risk, high-reward research projects; this surge in risk-taking is likely to drive up patent applications per million population, accelerate total-factor productivity convergence toward the technological frontier, and bolster the nation’s Global Competitiveness Index ranking.

The Decentralized Decision-Making shock shifts project-approval and budget-allocation authority from central ministries to individual research institutions, cutting regulatory approval lead times and reducing bureaucratic friction; faster R&D approvals will improve the ease-of-doing-business percentile and contribute to climbing positions in global competitiveness metrics.

The Institutional Commercial Rights and Revenue Share shock grants organizations ownership of discoveries and a guaranteed share of commercialization revenues, aligning academic incentives with market outcomes and deepening academia–industry linkages; this is expected to increase public–private joint-research projects, attract technology-focused FDI, and expand the country’s high-tech export market share.

The Performance-Based Funding Model shock ties financial support to measurable performance outcomes, rewarding high-performers and curtailing funding for underachievers; by channeling resources toward the most productive institutions, overall gross domestic R&D expenditure (as a share of GDP) will rise, spurring tech-driven total-factor productivity growth and lifting real GDP growth over the medium term.

References for this Development

Đề xuất chấp nhận rủi ro trong hoạt động khoa học, công nghệ và đổi mới sáng tạo

Proposal for accepting risks in scientific, technological and innovative activities

VTV News | Local Language | News

Người nghiên cứu khoa học được miễn trừ trách nhiệm nếu thất bại

Scientists are exempt from responsibility if they fail.

Dantri | Local Language | News

-

Vietnam Enacts Preferential Policies and Legislative Reforms to Accelerate Innovation and Technology Development

Vietnam’s government has introduced a series of policies and legislative proposals to foster innovation and science and technology development.

The Government issued Decree No 97/2025/ND-CP, effective May 5, 2025, to establish preferential mechanisms for the National Innovation Center at Hoa Lac. It exempts foreign experts and managers from work permit requirements when Vietnamese labor cannot fill positions, aligning confirmation procedures with existing Labor Law provisions. Investment projects at the Center and innovative startups can access state investment credit loans once they meet specified conditions, and non-budgetary state financial resources will support their activities. The decree waives infrastructure usage fees for technical infrastructure land leases and exempts site clearance, compensation, and resettlement costs, while the state covers site leveling expenses. It authorizes the Center to deliver public career services—incubation, training, consulting—and to provide shared laboratory and workspace access by leveraging public facilities and intellectual property to foster startup development.

The National Assembly’s draft Law on Science, Technology and Innovation aims to shift Vietnam from a technology adopter to a master of strategic technologies by prioritizing state budget allocations for R&D in key areas.

It assigns research and development tasks to enterprises and institutions based on performance and output efficiency and plans investment in advanced laboratories and technical infrastructure. The draft grants organizations and individuals greater operational autonomy in innovation, establishes accountability and transparency in resource management, and allows entities to retain ownership of research results for commercialization. Researchers would receive at least 30 percent of generated income and benefit from tax incentives. The proposal also transfers basic research functions to higher education institutions, promotes the integration of training, research, and innovation, and encourages collaboration across diverse research bodies.

Resolution No 68, signed by General Secretary To Lam, targets private economic development by addressing capital constraints for small and medium-sized enterprises (SMEs) and startups.

It calls for diversified capital sources, prioritizing commercial credit for SMEs, green and digital transformation industries, and innovative startups. The state will support interest rates on loans that meet environmental, social, and governance standards, complete a transparent legal framework for the SME Development Fund, and broaden capital supply through local and private investment funds. The resolution promotes peer-to-peer lending and crowdfunding to strengthen direct capital connections and improves data sharing between banks and agencies to refine credit assessments. It also encourages the use of social insurance and pension funds for long-term investments and seeks to upgrade the stock and insurance markets while developing corporate bond regulations.

Collectively, these measures emphasize the role of science and technology in enhancing national competitiveness and socio-economic development.

The draft law and associated policies expand regulatory scope to include the non-public sector, positioning enterprises at the core of innovation alongside universities and research institutes. The National Committee on Science, Technology and Environment has proposed clarifications on risk acceptance, research ethics, profit-sharing in state-funded projects, and regulatory linkages to streamline enterprise-driven innovation. These initiatives aim to create a supportive legal and financial ecosystem that stimulates productive forces, refines governance methods, and integrates training, research, and commercialization to prevent technological lag and support modern nation-building.

IMPACT ANALYSIS

From this Development, various impacts could cascade through the system, to a lesser or greater extent, depending on the severity and criticality of the shocks.

BOTTOM LINE

The Work Permit Exemption for Foreign Experts shock will dramatically accelerate the onboarding of global talent to the National Innovation Center, which could expand Vietnam’s STEM workforce, increase patent applications per capita, and drive higher AI adoption that uplifts GDP growth.

Granting Researchers’ Ownership and Profit‐Sharing Rights will realign incentives toward market‐driven innovation, leading to stronger intellectual‐property protection, higher‐impact patents, expanded high‐tech exports, and measurable gains in total‐factor productivity.

The Strategic R&D Budget Reallocation and University‐Led Basic Research shock will strengthen the university–industry tech‐transfer framework, boost public–private joint‐research project counts, improve returns on R&D investment, and elevate Vietnam’s Global Innovation Index ranking.

Diversification of SME and Startup Financing Channels will increase SME loan‐approval rates and venture‐capital deal flow, spur higher unicorn density, and expand the digital and knowledge‐intensive sector’s share of GDP.

Formal Integration of the Private Sector as Core Innovation Drivers will enhance regulatory quality, shorten approval lead times, accelerate business formation, and drive non‐farm labor productivity growth through more widespread adoption of modern management and digital tools.

The adoption of Regulatory Sandbox and Agile‐Regulation Policies will lower data‐localisation compliance costs, expand domestic AI compute capacity, and speed AI deployment across industries, yielding stronger productivity gains and additional GDP uplift from AI.

Increased Government Procurement of Innovation will create reliable demand for homegrown technologies, raise five‐year survival rates for scale‐ups, and, by anchoring public–private R&D, generate sustained total‐factor productivity growth from technology.

Stable Public Basic‐Research Funding will raise semiconductor fab utilization rates, attract more venture‐capital investment, and foster new high‐tech unicorns in semiconductors and related sectors, reinforcing Vietnam’s broader innovation ecosystem.

References for this Development

Cơ chế, chính sách ưu đãi đối với Trung tâm Đổi mới sáng tạo Quốc gia

Mechanisms and preferential policies for the National Innovation Center

Bao Dien Tu | Local Language | News

Nghị quyết 68 khuyến khích doanh nghiệp ESG, thúc đẩy khoa học công nghệ

Resolution 68 encourages ESG businesses, promotes science and technology

Dantri | Local Language | News

Hôm nay Quốc hội bàn chính sách đột phá phát triển khoa học công nghệ

Today the National Assembly discussed breakthrough policies for science and technology development.

VN Express | Local Language | News

Quốc hội nghe báo cáo về dự án Luật Khoa học, công nghệ và đổi mới sáng tạo

The National Assembly heard a report on the draft Law on Science, Technology and Innovation.

Bao Dien Tu | Local Language | News

Những chính sách ưu đãi đối với Trung tâm Đổi mới sáng tạo Quốc gia

Preferential policies for the National Innovation Center

VTV News | Local Language | News

-

New Taiwan Dollar Surge Triggers Market Volatility and Sectoral Shifts

OG IMAGE: Liberty Times Net | 2025-05-07 | Taiwan | Local Language

The New Taiwan dollar’s sharp appreciation against the US dollar has triggered volatility in Taiwan’s tech, semiconductor sectors, and related ETFs.

The New Taiwan dollar rose from around NT$31 per US dollar to as strong as NT$29.59, briefly crossing the NT$30 threshold intraday. Over two trading days the currency gained NT$1.872—its largest single-day increase since 2000—prompting comparisons to Japan’s post-1985 Plaza Accord and concerns about export competitiveness. Equity and bond markets reacted sharply, reflecting the surge’s broad impact.

Market participants point to multiple drivers behind the rally.

Optimism over Taiwan-US trade and tariff negotiations has attracted foreign capital into Taiwanese equities, boosting demand for New Taiwan dollars. Exporters have sold US dollars they held, creating supply-demand imbalances. Media references to the Big Mac Index and rumors of accords such as the so-called Mar-a-Lago deal spurred herd behavior, leading local investors to redeem overseas assets and repatriate funds, while life insurers adjusted their dollar positions.

Central Bank Governor Yang Jinlong called these movements excessive and warned of speculative forces seeking to exploit the volatility.

He noted key differences from the 1980s Plaza Accord era—greater capital mobility, larger markets and a shift toward tariffs over coordinated interventions—and denied any pressure from the US Treasury to engineer appreciation. He emphasized that Taiwan’s economy remains robust, with 4.59% GDP growth in 2014 and an estimated 5.37% in the first quarter of 2015.

To counter disorderly conditions, the Central Bank has pledged close monitoring of fund flows and signaled readiness to intervene if volatility persists.

Officials urged analysts and manufacturers to avoid speculative commentary that might destabilize expectations. Premier Chuo Jung-tai reaffirmed the government’s non-manipulation policy and directed regulators to probe any irregular trading activity.

Sectoral impacts vary widely.

Export-oriented industries, particularly electronics and semiconductors, face exchange losses and compressed margins—analysts predict a 45% decline in gross profit margins and up to a 7.5% profit reduction for every 10% appreciation. Banks, hardware and IC design firms, which naturally hedge through dollar-denominated sales, have weathered the surge more effectively. Conversely, import-dependent and domestic demand-driven sectors—such as food manufacturing, asset holdings and construction—benefit from lower costs and asset revaluations. Life insurers confront uncertain hedging results given their substantial US dollar liabilities.

In equity markets, the Taiex index fell more than 250 points (1.23%), driven by losses in financial and technology stocks, even as foreign institutional investors net-purchased NT$24.46 billion.

Bond ETFs, especially US Treasury and long-duration funds, dropped over 6.5%, illustrating the exchange rate’s effect on dollar-denominated assets. Some investors now hold higher cash positions to navigate ongoing fluctuations.

Opinions diverge on the rally’s persistence.

Experts at Cathay United Bank and Taishin Bank doubt the New Taiwan dollar will appreciate much further given stabilizing US dollar yields and the unlikelihood of a Plaza-Accord-style intervention. JPMorgan points to a wider repatriation of Asian dollar assets, suggesting market dynamics rather than policy pacts drive the moves. Others caution that a swift but short-lived rally could expose investors to a rapid reversal.

The New Taiwan dollar’s recent surge has intensified regulatory scrutiny, strained exporters, produced mixed effects across industries and sparked debate over its drivers—from trade talks and capital flows to speculative trading and structural economic shifts.

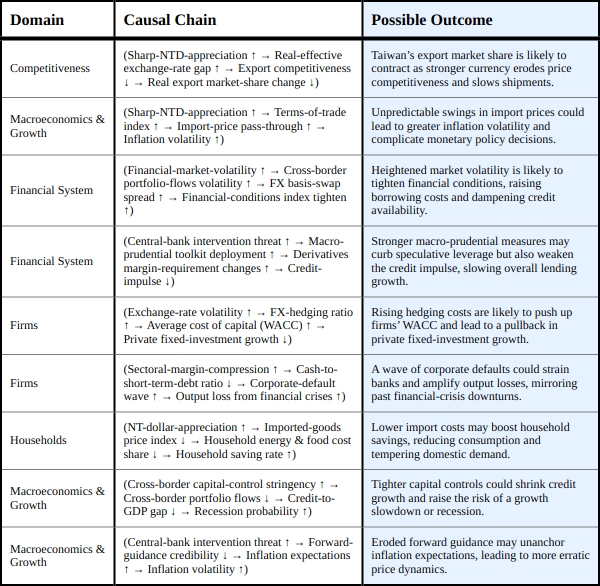

IMPACT ANALYSIS

From this Development, various impacts could cascade through the system, to a lesser or greater extent, depending on the severity and criticality of the shocks.

BOTTOM LINE

• The New Taiwan dollar’s sharp appreciation—driven by optimism over Taiwan-U.S. trade talks, exporters’ U.S.-dollar sales, repatriation flows, and speculative herd behavior—constitutes a major shock that has raised the real-effective exchange rate and eroded export competitiveness, risking a contraction in Taiwan’s export market share.

• The attendant financial-market volatility shock, exemplified by a 1.23% Taiex decline and over 6.5% drop in bond ETFs despite foreign net purchases, is likely to tighten financial conditions by widening FX basis-swap spreads, elevating hedging costs, and raising borrowing rates for firms and households.

• Sectoral profit-margin compression is a shock concentrated in export-oriented electronics and semiconductor firms—where margins may fall by up to 45%—that can deplete corporate cash buffers, increase leverage, and heighten the risk of a wave of defaults with knock-on effects on the banking sector and economic output.

• The central bank’s threat of intervention and regulatory probes represents a shock that may trigger heightened macro-prudential measures—such as increased derivatives margin requirements—thereby curbing speculative leverage but simultaneously reducing the credit impulse and slowing new lending and investment.

• Elevated exchange-rate volatility is a shock that pushes firms to increase FX-hedging ratios, raising their weighted average cost of capital (WACC) and dampening private fixed-investment growth as higher financing costs force postponement or scaling back of projects.

• Cheaper imports from the NTD’s appreciation create a household-level shock by lowering energy and food prices, which is likely to boost the household saving rate while tempering consumption and domestic demand growth.

• In response to rapid FX swings, tighter capital-control measures are a potential shock that could restrict cross-border portfolio flows, shrink the credit-to-GDP ratio, and increase the probability of a growth slowdown or technical recession.

• Frequent warnings of currency intervention may erode the central bank’s forward-guidance credibility, constituting a shock that risks unanchoring inflation expectations and increasing inflation volatility, further complicating monetary policy decisions.

References for this Development

Taiwan dollar unlikely to rise to NT$28 against greenback: Analyst

Focus Taiwan | English | News

風評:台幣災難性大升值,台美談判黑箱作業

The Storm Media | Local Language | News

新台幣急升 多檔熱門美債ETF淪重災區!

The New Taiwan Dollar surged and many popular US Treasury ETFs were hit hard!

ETtoday | Local Language | News

台幣強升、美元持續走弱,日圓將成最大贏家?5大銀行點名「2貨幣」後勢最強

The Storm Media | Local Language | News

新台幣狂飆瘋換匯!巴菲特看衰美元「重押1資產」

Yahoo News Taiwan | Local Language | News

Central bank urges commentators not to speculate on NT dollar strength

Focus Taiwan | English | News

U.S. dollar closely sharply lower on Taipei forex market

Focus Taiwan | English | News

Taiwan shares end sharply down on rapid Taiwan dollar appreciation

Focus Taiwan | English | News

台幣成亞洲最強勢貨幣 國泰世華:今年要進一步大幅升值難度高

Yahoo News Taiwan | Local Language | News

新台幣匯率激升一度29字頭 央行列7點聲明:美方未要求台幣升值

TTV News | Local Language | News

新台幣暴力飆升!學者分析對台利弊揭「央行的難言之隱」

Yahoo News Taiwan | Local Language | News

台幣暴衝 學者曝股匯不同調不像外資匯入

Liberty Times Net | Local Language | News

匯價閃見29字頭 楊金龍急喊話/匯損衝擊權值股 台股翻黑跌254點/新台幣升值概念股爆發 資產營建全面上攻|Yahoo財經掃描

Yahoo News Taiwan | Local Language | News

台幣升值怎麼影響台股?三面向解析對中長期壓力

United Daily News | Local Language | News

貨幣戰首部曲》資金找去處 外資:台股有回補條件

Yahoo Finance | Local Language | News

台幣狂升禿鷹疑似現蹤 楊金龍解析匯市關鍵問答一次看

United Daily News | Local Language | News

美股跌台指期夜盤失守20200點 法人:台股關注匯率變數

United Daily News | Local Language | News

台幣升1% 台股營利掉0.1%起跳

Taiwan dollar rises 1%, Taiwan stock market profit drops 0.1%

Liberty Times Net | Local Language | News

台幣強升該手刀搶買美元?郭正亮曝1關鍵「先別急」:還沒到最低點

The Storm Media | Local Language | News

美金匯價見29字頭,搶美元日圓、美元保單好時機?邱達生:1理由美元還會續跌,留點台幣等「這時候」

Yahoo News Taiwan | Local Language | News

散戶滿手「美元」遇台幣飆升怎辦? 3大情況皆有解

Yahoo News Taiwan | Local Language | News

台股ETF受益人數續創高 市值型ETF較受青睞

United Daily News | Local Language | News

00687B崩到直接破底?網嘆均價31.88元「套牢25張」:攤平或換美元

United Daily News | Local Language | News

台幣升值!不敗教主急了「把美金換台幣」嘆:挨了一巴掌

ETtoday | Local Language | News

新台幣失速狂飆!專家喊「急升總比急貶好」:對1群人不利、多是有錢人

Yahoo Finance | Local Language | News

台幣狂升 半導體緊張 食品業股漲

Taiwan dollar surges as semiconductors and food stocks rise

Liberty Times Net | Local Language | News

楊金龍坦言新台幣被「禿鷹」盯上、央行已提出警告,希望不尋常的波動到此為止

The Storm Media | Local Language | News

盤後/台幣狂升重挫台股 外資加碼244億 狂敲這幾檔!

Yahoo Finance | Local Language | News

新台幣驟升觸及26.9元 胡采蘋示警「國際炒家進場了!」

Yahoo News Taiwan | Local Language | News

新台幣早盤升破30元 台股下挫逾百點力守20400點

Central News Agency | Local Language | News

美國逼台幣升值?王鴻薇:楊金龍答話「這個神情」反加深市場疑慮

The Storm Media | Local Language | News

藍委批央行知匯率有異卻放手 卓榮泰:政府不採干預政策

United Daily News | Local Language | News

新台幣暴升、美債ETF重挫7%!該逃還是加碼?基金經理人曝3大保命策略

Yahoo Finance | Local Language | News

楊金龍要出面了!新台幣瘋狂升值引爆市場恐慌,央行下午召開臨時記者會

The Storm Media | Local Language | News

台幣狂升將複製1985年「廣場協議」?哲哲:不可能會重演因時空背景不同

United Daily News | Local Language | News

「為何匯率波動大?」央行總裁狂結巴 林智群曝:因為不能承認1事

ETtoday | Local Language | News

楊金龍「柳樹理論」有效 台幣回貶30大關台股翻紅

Yahoo Finance | Local Language | News

台幣匯率一路升到13元?謝金河揭「新台幣驚魂記」背後原因:肯定不會

The Storm Media | Local Language | News

台幣暴衝》美債ETF投資小白折價、匯損「吃全餐」 他沒逃含淚加碼

Liberty Times Net | Local Language | News

分析師:台幣升值 科技業受創最重

Analyst: Technology sector hit hardest by appreciation of Taiwan dollar

United Daily News | Local Language | News

新台幣急升 熱門美債ETF兩天暴跌1成淪重災區

Central News Agency | Local Language | News

新台幣狂升禿鷹伺機炒匯 楊金龍解析匯市關鍵問答一次看

Central News Agency | Local Language | News

新台幣強升如廣場協議?楊金龍:時空背景不復存在

Central News Agency | Local Language | News

台幣狂升釀「債券ETF大逃殺」?台股成交前十大占一半 金額爆逾241億

Yahoo News Taiwan | Local Language | News

台幣狂升!換美元竟「每家報價都不同」 央行曝真相

Yahoo Finance | Local Language | News

台幣狂漲!央行楊金龍親上火線7大喊話 「外界過度臆測」

Yahoo News Taiwan | Local Language | News

小摩:「貨幣風暴」正形成 巨大美元資產將回流亞洲各國

JPMorgan: "Currency storm" is forming and huge US dollar assets will flow back to Asian countries

Liberty Times Net | Local Language | News

嗆嚴查禿鷹操作匯率 卓榮泰:我們一定要穩下心來

Zhuo Rongtai: We must calm down and investigate vultures manipulating exchange rates

United Daily News | Local Language | News

-

Huawei accelerates push for AI chip self-sufficiency with new Shenzhen fabrication plants

China’s Huawei is advancing a comprehensive strategy to achieve self-sufficiency in high-end AI chip production.

Since 2022, Huawei has built and begun operating three advanced semiconductor fabrication plants in Shenzhen, marking its first major step toward independently mass-producing high-end chips.

The first facility, managed directly by Huawei, focuses on 7-nanometer smartphone chips and Ascend AI processors. By 2024, Huawei completed two more plants—owned by the company but operated by startups Si Carrier and Sway Sure, which specialize in chip equipment and memory-chip production, respectively.

Although Huawei denies formal corporate ties with Si Carrier and Sway Sure, it provides technical support, assists with fundraising, and collaborates on recruitment and management, creating a close working relationship.

The Shenzhen municipal government has also offered policy incentives and resources to accelerate each plant’s construction and operational readiness.

Huawei aims to cut its dependence on foreign suppliers in response to tightening US and European export controls.

Equipped with advanced process technologies, these Shenzhen facilities seek to rival industry leaders such as Nvidia, ASML, SK Hynix, and TSMC. Huawei plans to establish a vertically integrated AI semiconductor supply chain in China—spanning wafer fabrication, chip packaging, and in-house AI model development—in an effort analysts describe as unprecedented in scale and scope.

External experts call Huawei’s undertaking ambitious, given its relatively limited track record in advanced semiconductor manufacturing compared to established global competitors.

US sanctions that restrict Huawei’s access to critical equipment and design software remain a significant challenge. Nonetheless, the company relies on local government backing, dedicated investment in fabrication infrastructure, and its collaborative network of state-backed startups to drive toward self-sufficiency in the AI chip sector.

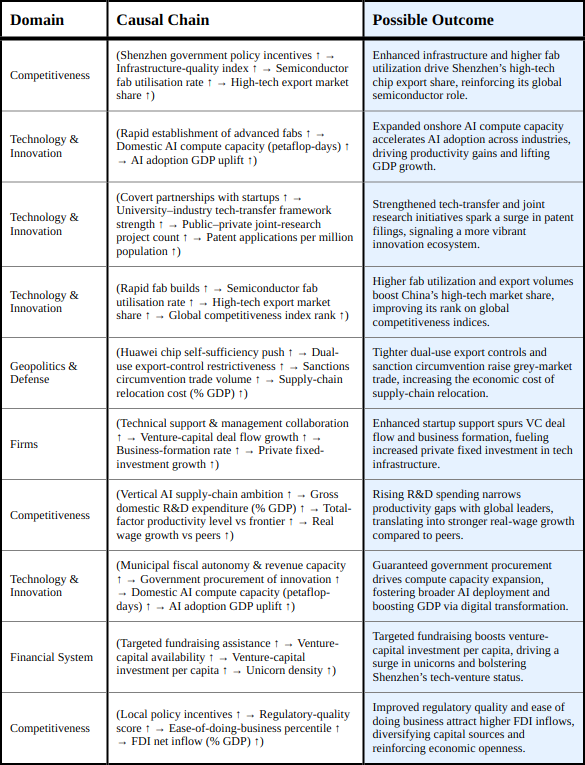

IMPACT ANALYSIS

From this Development, various impacts could cascade through the system, to a lesser or greater extent, depending on the severity and criticality of the shocks.

BOTTOM LINE

The rapid establishment of three advanced Huawei-linked semiconductor fabs in Shenzhen could drive up infrastructure-quality scores and fab-utilisation rates, resulting in higher high-tech chip export market share and an improved ranking on global competitiveness indices.

Huawei’s covert partnerships with Si Carrier and Sway Sure serve as a catalyst for strengthening university–industry tech-transfer frameworks, boosting the number of public–private joint-research projects and patent applications, and fueling venture-capital deal flows that accelerate semiconductor and AI startup formation and private fixed-investment growth.

Municipal government policy incentives—including targeted subsidies, expedited approvals, and direct procurement—function as a core driver by enhancing Shenzhen’s infrastructure and regulatory-quality metrics, accelerating fab operational readiness, and attracting greater FDI net inflows as a share of GDP.

The ambition to build an end-to-end domestic AI semiconductor ecosystem elevates gross domestic R&D expenditure as a share of GDP, narrows total-factor productivity gaps with frontier economies, supports real-wage growth, and expands domestic AI compute capacity to drive broader AI adoption and deliver a tangible GDP uplift.

Intensifying US and European export controls in response to Huawei’s self-sufficiency push could prompt tighter dual-use technology restrictions, spur grey-market sanction-circumvention trade, and elevate the economic cost of global supply-chain relocation, exacerbating geopolitical tensions in the semiconductor sector.

References for this Development

外媒曝華為在深圳興建3先進晶片廠 首次拚自製7奈米高階晶片

ETtoday | Local Language | News

外媒曝:華為深圳建廠「挑戰輝達、台積電」!拚自製7奈米高階晶片

ETtoday | Local Language | News

《各報要聞》台積2奈米躍進 供應鏈歡呼

Newspaper News: TSMC's 2nm Leap Forward into the Supply Chain

Yahoo Finance | Local Language | News

挑戰輝達與台積電霸主地位!金融時報揭華為野心:自製AI晶片、自建供應鏈抗美制裁

The Storm Media | Local Language | News

獨家》林佳龍6日率團赴美搭合作平台 德州打造AI供應鏈聚落

Yahoo Finance | Local Language | News

Cognitive Asia covers AI, semiconductors, and cloud computing-related issues for South Korea, Japan, China, Taiwan, India, and Vietnam.

We monitor news media, social media, government releases at the national and state/city levels, foreign embassies, business associations, podcasts, videos, and more, from 12 countries in Asia and around the world, to bring you the best, most current analysis available for both risk management and operations decision-making.

Business Asia

Want a report like this that focuses on business developments in Asia? We've got that in stock! Subscribe to Business Asia at businesseasia.substack.com.

Security Asia

Want a report like this that focuses on security developments in Asia? You're in luck. Subscribe to Security Asia at securityasia.substack.com.

This report is provided as an informational resource for subscribers and represents our diligent and good faith efforts to compile and analyze the best information available to us at the time of writing. The content herein is derived from various sources, including, but not limited to, news articles, government publications, and data releases. We make no representations or warranties, express or implied, as to the accuracy, reliability, or completeness of the information provided in this report. It is important to note that we have not independently verified the assertions and information obtained from these third-party sources.

The information contained in this report is provided "as is" without warranty of any kind. The use of this report and the information within it is at the sole risk of the subscriber/reader. We expressly disclaim all warranties, whether express or implied, including, but not limited to, implied warranties of merchantability, fitness for a particular purpose, and non-infringement. We do not warrant that the information in this report will meet your requirements or that the operation of the information will be uninterrupted or error-free.

While every effort has been made to ensure the accuracy and completeness of the information contained within this report, we cannot guarantee that it is free from errors or omissions. We are not responsible for any actions taken or not taken based on the information provided in this report. Subscribers and readers should conduct their own due diligence as necessary before taking any action based on the information herein.